Are my purchases of Gold and Silver through IGASC Ltd private?

Yes, in Israel precious metal dealers have zero reporting obligations about our buyers to the Tax Authorities in Israel or the United States.

Is there VAT in Israel when I purchase precious metals for investment?

If your purchase of gold and silver is for investment purposes then there is 0% VAT.

All other purchases for private or business incur 17% VAT.

So in Israel, a $1,200 American Gold Eagle purchase for investment will cost $1,200 and if purchased for private or business use it will cost $1,404 (including 17% VAT).

My personal taxes – Israeli Capital Gains when I sell my coins

In Israel the difference between the cost you purchase gold through IGASC Ltd for and the cost you sell it for, is called a capital gain or loss. The tax rate in Israel is 25%.

If you buy a coin for $1,000 and the price rises to $1,100 and you sell your coin for that price; then you will need to pay capital gains tax at a rate of 25% of the $100 capital gain you earned, you will pay tax on $25.

My personal taxes – Reporting my gold to the Israel Tax Authority – Hatsarat Hon

Self-employed individuals and greater than 10% shareholders in companies are requested to file a Hatsharat Hon (Capital Declaration) at the outset of their businesses and every 3 years, listing their personal assets and liabilities. This is to help the Tax Authority see if the increase in assets have outstripped reported income. You would need to report you physical gold assets in such a report. There is currently no wealth tax nor estate/inheritance tax in Israel. New Immigrants do not need to report overseas assets in their 10 year Israeli tax holiday.

My personal taxes – Reporting my gold to the IRS – US Reporting – Form 8938

Form 8938 is a US tax reporting form which all US citizens need to report if the total value of their foreign financial assets is more than the reporting threshold. The reporting threshold ranges from $300,000 for unmarried taxpayers to $600,000 for married taxpayers.

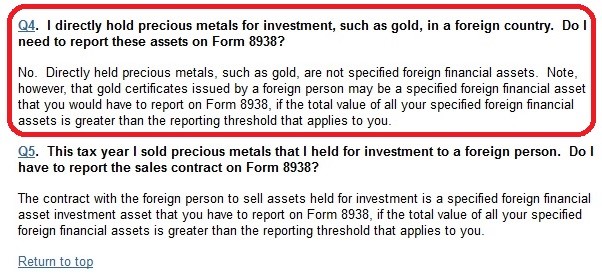

Are there any reporting requirements to the IRS for Physical Gold bullion held privately outside of the United States?

Answer: No

My personal taxes – FBAR

Are physical precious metals stored in Israel in my personal name outside the banking system reportable on my FBAR ?